30+ Typical mortgage interest rate

Both are tipping the RBAs benchmark official rate to peak at 335 per cent it is currently 185 per cent meaning interest rates would almost double from where they are rising by another. 30-year fixed rate mortgage.

Interest Rates Mississauga Real Estate Mls

Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien.

. The interest rate remains the same for the life of the loan. A mortgage rate is the interest lenders charge on a mortgage. The average rate for a 30-year mortgage has topped 6 for the first time since 2008 hitting 602 last week.

View our up to date mortgage interest rates. This rate is more extreme than typical APRs can be as high as 2999 and will be. View daily mortgage and refinance interest rates for a variety of mortgage products and learn how we can help you reach your home financing goals.

Heres a look at some other available mortgage structures and how they might suit your home purchasing needs. Or any other payment equal to or greater than the minimum. 31118 20000 down payment plus 11118 paid.

30-Year Fixed Rate Mortgage Average in the United States. For instance in February 2010 the national average mortgage rate for a 30 year fixed rate loan was at 4750 percent 5016 APR. View data of the average interest rate calculated weekly of fixed-rate mortgages with a 30-year repayment term.

Mortgage rates valid as of 12 Sep 2022 0248 pm. Freddie Mac is also well-known for offering 30 year fixed-rate mortgages giving buyers the opportunity to. A 30-year mortgage will have the lowest monthly payment amount but usually carries the highest interest ratewhich means youll pay much more over the life of the loan.

A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. Unless you like the idea of paying thousands of dollars. The 30-year fixed-rate mortgage is 24 basis points higher than one week ago and 335 basis points higher than.

Sign On Customer Service. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. Unlike some other mortgages options the interest rate on FHA loans wont be altered throughout the repayment process.

Freddie Mac 30-Year Fixed Rate Mortgage Average in the United States MORTGAGE30US retrieved from FRED Federal Reserve Bank of St. Mortgage rates hit their highest point since November 2008 this week crushing homebuyer demand. The trade-off with a 15-year term is a significantly higher monthly payment however because your repayment term.

15 year to 30 year loans. By driving mortgage rates higher the Fed made monthly mortgage payments more. Cost per 1000 over 30 yrs.

A home loan designed to be paid over a term of 30 years. The quoted APRC is a typical APRC based on an assumed loan of 100000 over a 20 year term. Mortgage loan basics Basic concepts and legal regulation.

Typical interest rate adjustment periods for an I-O mortgage are monthly every 6 months or once a year. The spreads change over time but the 15-year is typically about a half a percent lower than the 30-year. The rate on the 30-year fixed mortgage jumped to 589 from 566 the week prior according to Freddie MacRates have surged nearly three-quarters of a point in just three weeks and are now over 25 percentage points higher than the start of this year.

A 15- 30- or 40-year term. A 30-year fixed-rate mortgage is the most popular type of mortgage because of its affordability and stability. A typical mortgage before 1930 only had a 3 to 5 year period.

While both loan types have similar interest rate profiles the 15-year loan typically offers a lower rate to the 30-year loan. Meanwhile the 15-year fixed-rate mortgage typically comes with a lower interest rate when compared with a 30-year loan. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years.

A mortgage in itself is not a debt it is the lenders security for a debt. APRC stands for Annual Percentage Rate of Charge. For a better understanding of typical mortgage interest rates and how they evolve over time lets take a closer look at average mortgage rates since 2019.

Mortgage rates come. 2 Year Fixed Rate New Business - less than or equal to 60 LTV. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Toggle menu MENU. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. The interest-only adjustable-rate mortgage ARM allowed the homeowner to pay only the interest not principal of the mortgage during an initial teaser period.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. The buyer decides they want to lower their interest rate for the first 3 years with a 3-2-1 buydown. Assessed Interest Rate of Accounts with Finance Charges Prime Rate Interest Rate Margin of All Credit Card Accounts Interest Rate Margin of Accounts with Finance Charges 30 Credit Card Delinquency Rate Unemployment Rate Charge-off Rate.

Lets say a buyer wants to borrow 400000 and qualifies for a 30-year fully amortized mortgage at an interest rate of 5. LTV stands for Loan to Value. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher.

Interest Rate of All Credit Card Accounts Avg. On Wednesday September 14th 2022 the average APR on a 30-year fixed-rate mortgage fell 3 basis points to 6075The average APR on a 15-year fixed-rate mortgage fell 4 basis points to 5215. Todays national jumbo mortgage rate trends For today Wednesday September 14 2022 the national average 30-year fixed jumbo mortgage APR is 6250 increased to compared to last weeks of 6120.

Mortgage rates vary depending upon the down payment of the consumer their credit score and the type of loan that will be acquired by the consumer. The points paid upfront reduce the interest rate by 1 for each of those first 3 years. With an adjustable-rate mortgage your interest rate can change periodically.

The Fed raised rates from the unusually low level of 1 in 2004 to a more typical 525 in 2006. The FHA began offering 15 year to 30 year loans stretching out payments and making it more affordable for medium-income individuals to buy a home. Open Table View 3Y Filter 3 years data 5Y Filter 5 years data 10Y Filter 10 years data.

FHA loans are typically made on a 30-year fixed rate amortization plan but can also be purchased on a 15 year plan. Most I-O payment mortgages and payment-option ARMs have payments that adjust once a year.

Fixed Vs Variable Rate During Increasing Rates Canadian Money Forum

30 Flowchart Examples With Guide Tips And Templates Business Infographic Infographic Marketing Starting Your Own Business

Should You Pay Off A Mortgage Early Part Ii Charts And Graphs

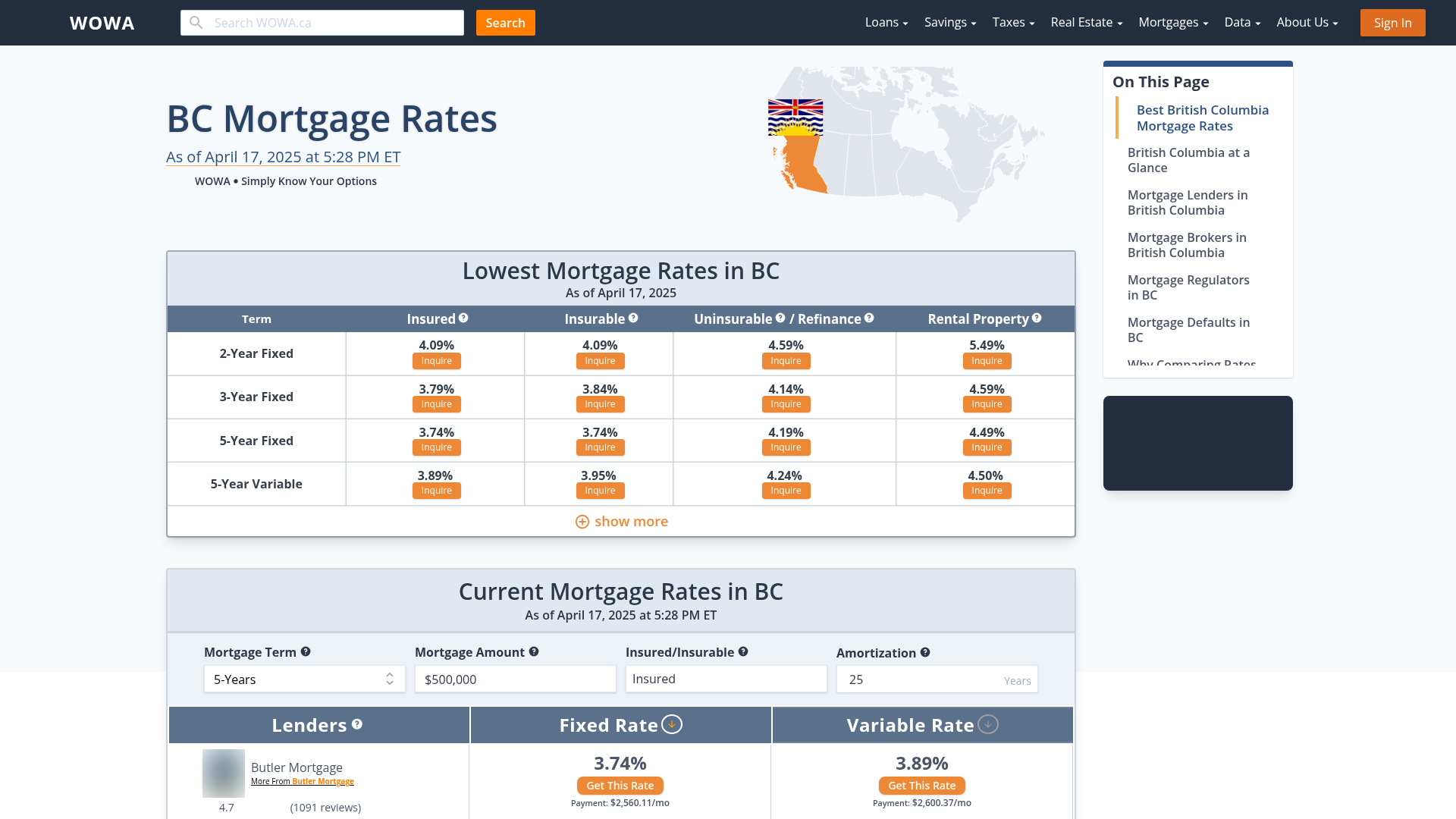

Latest Mortgage Rate Outlook In Canada For Sept 2022 Perch

How Much Does New Home Construction Cost Home Construction Cost New Home Construction Construction Cost

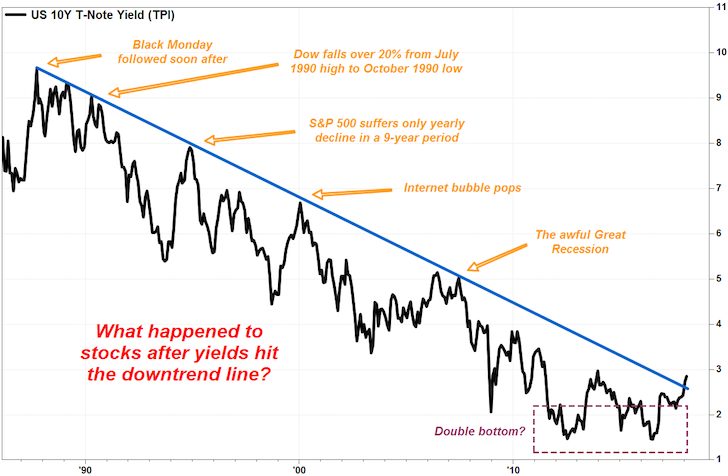

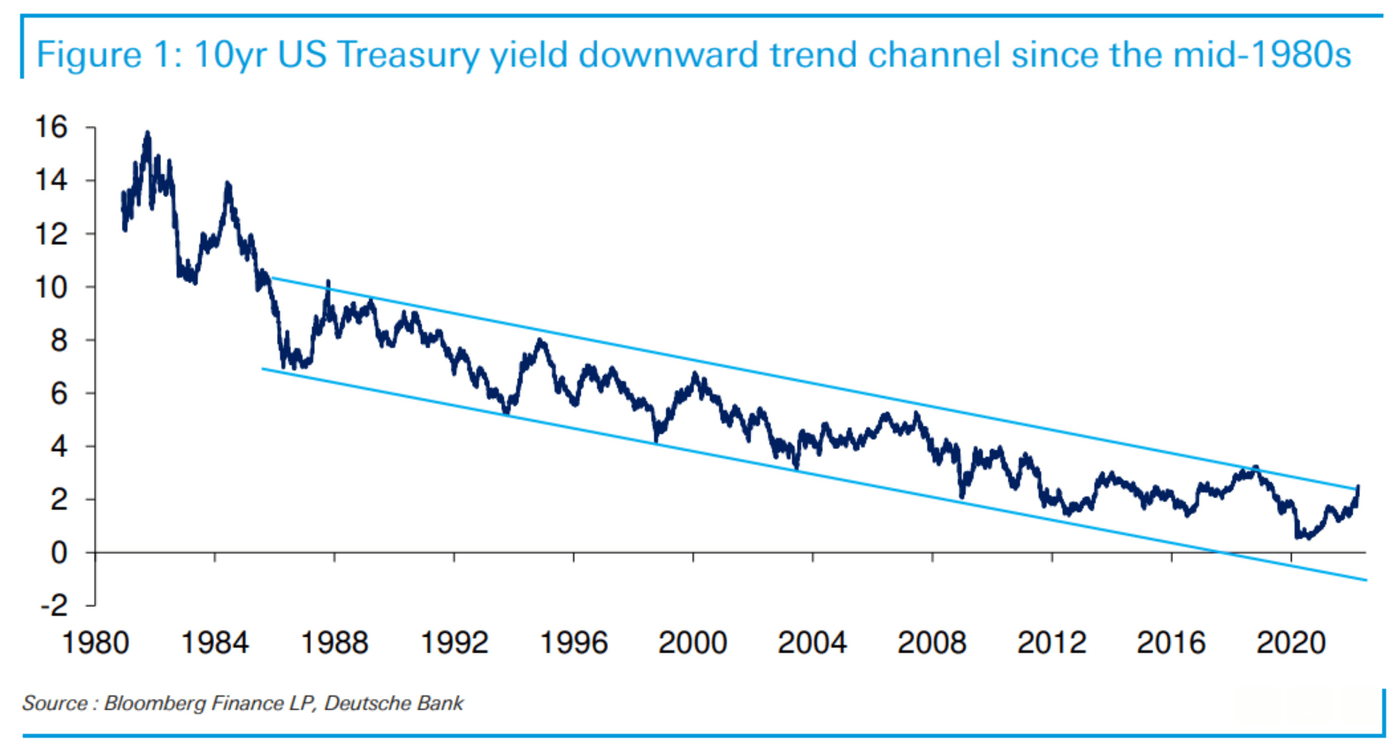

Why Are Interest Rates So Low

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

A Refinance Opportunity Has Emerged Mortgage Rates Have Declined

Compare Home Loans Business Loans Overseas Property Financing Hdb Housing Loans And Commercial Property Mortgages Vis Finance Loans Mortgage Mortgage Loans

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

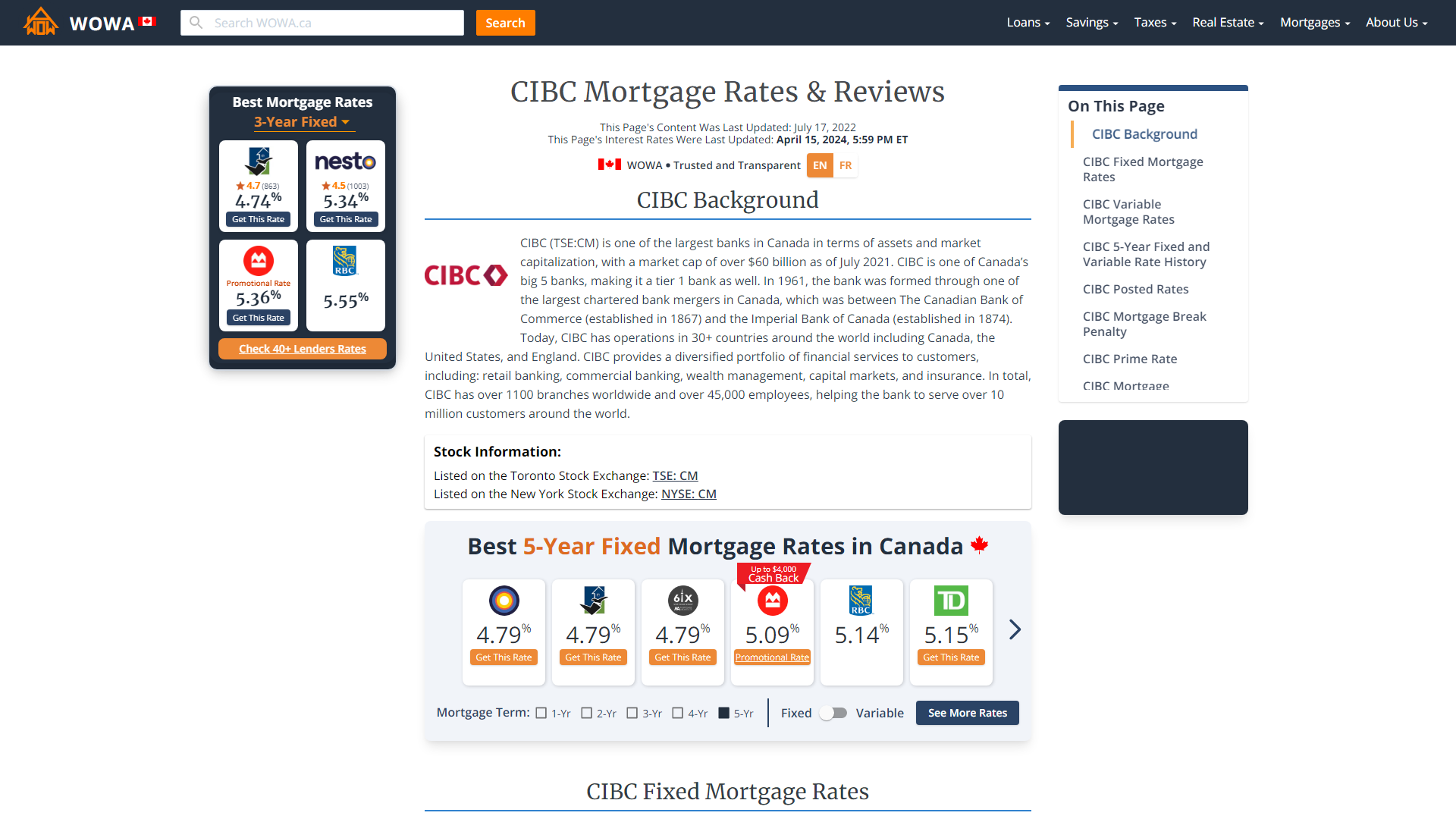

Cibc Fixed And Variable Mortgage Rates Sep 2022 From 5 14 Wowa Ca

Do Interest Rates Historically Impact Housing Prices Quora

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

Should You Pay Off A Mortgage Early Part Ii Charts And Graphs

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Vh Zjri4vdockm